Every CRN site visitor has access to comprehensive debt settlement education and detailed information about different debt management tools that can help you succeed with your debt relief plan. That’s great! That is what our web site is designed to do – help you get informed about dealing with debt and credit issues. We have a dedicated YouTube channel, Debtbytes, that offers even more tutorials and diy debt help. We also know there are valid reasons to work with a professional who can guide you through your debt relief decision making process and assist you through settling your debts with banks and debt collectors.

Meet the professionals in our network who can help you with your individualized debt relief goals:

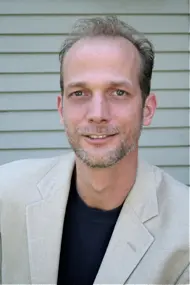

Michael Bovee: I founded CRN with a dedication to providing education and awareness about your ability to navigate debt and credit struggles yourself, as an alternative to using overpriced and often ineffective debt settlement services. I focus the majority of my time on publishing CRN’s credit and debt relief website and videos. I interact with site visitors every day by responding to reader questions and offering help and feedback to those posting comments.

Michael Bovee: I founded CRN with a dedication to providing education and awareness about your ability to navigate debt and credit struggles yourself, as an alternative to using overpriced and often ineffective debt settlement services. I focus the majority of my time on publishing CRN’s credit and debt relief website and videos. I interact with site visitors every day by responding to reader questions and offering help and feedback to those posting comments.

Currently I provide one on one consultations for site visitors, while accepting a limited number of new clients.

Paul Wisuri: I have worked with and known Paul for 9 years. Paul has extensive experience in the debt and credit markets. He has over 30 years of management experience working for major financial institutions. He is a full time specialist in the Network. Paul has been recognized nationally for his dedicated work as a CASA counselor.

Paul Wisuri: I have worked with and known Paul for 9 years. Paul has extensive experience in the debt and credit markets. He has over 30 years of management experience working for major financial institutions. He is a full time specialist in the Network. Paul has been recognized nationally for his dedicated work as a CASA counselor.

Paul can help coach you through negotiating settlements yourself, and also provides direct debt negotiations.

Charles Phelan: Charles pioneered DIY debt settlement education with coaching. I met Charles many years back when involved in efforts to create CRN’s “do it yourself” debt settlement materials. I reviewed the course he put together for his customers, and quickly realized I could not improve on them. A re-branded version of Charles’s Debt Settlement Success Seminar was shipped to all CRN members for many years.

Charles Phelan: Charles pioneered DIY debt settlement education with coaching. I met Charles many years back when involved in efforts to create CRN’s “do it yourself” debt settlement materials. I reviewed the course he put together for his customers, and quickly realized I could not improve on them. A re-branded version of Charles’s Debt Settlement Success Seminar was shipped to all CRN members for many years.

Charles is dedicated to providing a tailored debt settlement strategy to his clients that is highly effective. He is a one of the better recognized debt settlement experts in the US.

Jared Strauss: I met Jared through a debt relief industry friend several years ago. Jared’s approach to negotiating and settling debts with his customers is not only unique, he is highly effective. His customer success rate is stellar, which can be attributed to his client suitability standards. Jared has been assisting people with debt negotiations for over a decade. Prior to working with people to help them achieve debt relief, Jared received awards for his achievements as a debt collector.

Jared Strauss: I met Jared through a debt relief industry friend several years ago. Jared’s approach to negotiating and settling debts with his customers is not only unique, he is highly effective. His customer success rate is stellar, which can be attributed to his client suitability standards. Jared has been assisting people with debt negotiations for over a decade. Prior to working with people to help them achieve debt relief, Jared received awards for his achievements as a debt collector.

Jared is dedicated to offering full service debt negotiation and settlement.

Check out my interview with Jared in one of our YouTube videos.

Andrew Weber: I got to know Andrew through a colleague who settles most types of debt, but not student loans. He had been referring people to Andrew who needed assistance negotiating private student loans. While Andrew is focused on helping with private loans, watch the video I did with him where he shows he knows a thing or two about repaying federal loans too!

Andrew has been assisting people to resolve student loans for several years.

Working with a debt settlement professional

Here is just a brief outline of why you should consider working one on one with an experienced debt settlement professional to resolve your debt:

- Know when your specific creditors are going to negotiate a debt for less then you owe.

- How to negotiate and save the most when settling your debt with each one of your creditors.

- How different debt collectors that call and send you collection letters are best handled in order to get the best settlement, or payment terms.

- How to manage multiple collection accounts and debt collectors until you are free from debt.

- How to reduce balances AND get time to pay a settlement with your credit card bank, debt collectors, and debt buyers, in order to limit your risks of being sued.

- How to settle debts when collections have already been to court and how to best resolve judgments you already have.

- How to limit damage to your credit report when settling credit cards and other debts.

- How to deal with other accounts you are not settling, while negotiating the best outcome on others.

One on one support provided by a dedicated specialist who will be assisting you in designing and implementing debt relief strategies that are tailored to you, your goals and needs, not only makes sense, but helps you maximize your results.

You can settle your debt while being guided by a pro, and for a fraction of what it would cost to enroll with a typical debt settlement company. You have access to professionals that will negotiate and settle your debts for you.

The approach we advocate to settling your debt provides the flexibility that is missing from other options available to you to manage your debt. We have had tremendous success working with our customers and site visitors since 2004.

Debt relief program costs:

Most of the specialists you can connect with through this site have more than a decade of experience working directly with people to help them succeed with their debt and credit goals. All of us recognize the benefit of working with you to first understand how to best reach your financial goals.

Happy New Year Mr Bovee ,

I do not know if you are still involved in your business but in short let me say that 2024 was a horrible year for me in that I am the type of person who will leave no stone unturned until I find a solution but Discover credit card and dealing with them and I will explain when we speak well I allowed my situation to ruin my health and I refuse to let my situation do that . So I am seeking your brilliance advice and guidance on what I can do with my debt situation because what people have told me to do and what I have almost gotten sucked into would have ruined me and the bummer of it all is that when I look at my credit I don’t see any late payments but I got denial after denial for balance transfers and creditors are merciless when asking for grace periods with lower interest . It’s like They want you to default . So I’m determined to solve this . But I can’t do it without advice of someone who is not trying to scam me or take advantage of me I didn’t use credit cards to take lavish trips or buy lavish clothes . I hit a tight spot and had to

Use them for living and medical . I’m sure I am one of millions but the government honestly does nothing to regulate credit card interest and debt relief companies say they’re going to settle and then they don’t . I hope to hear back . Thanks so much

I would suggest scheduling a call with me using the Get Help tab at the top of each page on this site. I can help you understand the options that may work for you on that call.

hello about 2 years ago my someone used my identity to start a verizon wirless contract and now im stuck with the bill for 5,100 Dollars which is alot more than i can afford is there anyway out of this or at least a way to take care of if with low payments

This sounds like a version of ID theft. I would follow the tips laid out in this article: https://consumerrecoverynetwork.com/identity-theft-prevention/

Hello CRN I have two capital one credit card both when to charge off status, I been paying a in house debt collector who deals with capital one. I owe ($1050)on one account and ($2800)on the other ,I want to negotiate to settle on both accounts to rebuild my credit, it been 3years sense charged off, what is the lowest $$ among to settle both accounts I listen to your YouTube videos, capital one will not delete off my credit report for Payment in full can you give me some advice tks u Briscoe

I would encourage you to get help on these Lawrence. You can create a user profile and schedule a call with me, or one of the other counselors, using the Get Debt Help tab at the top of the page.

Hello,

In 1999 my wife and I purchased and financed a vehicle. We had a loss of income and it was repossessed about 6 months later. There was a deficiency balance of 8,146 and at the time I tried to make pmt arrangements But the collection folks would only accept pmt in full. I stopped receiving communications and when I went to refi my home a year or so ago and was informed that I had a lien on my property which prevented me from being able to refi. There was a judgement granted in 2009 which I was unaware of, the title company was able to provide me a copy an looks like the judgement was for the deficiency balance but with interest accrual beginning April 2006. This is being handled by an attorneys office and they said the balance is around 28,000 with all of the interest. I want to get this settled so I can refinance and want to find out the best way to go about it. I have not talked with them or mentioned that i am trying to refinance. Thanks!

Check out this post about settling judgments: https://consumerrecoverynetwork.com/question/can-you-settle-credit-card-judgements-like-other-debts-stressed/

How much equity do you have in the home?

Hello CRN,

I sold my home in a short sell and I agreed to a $20,000 note to pay to the credit union (NFCU). I the remainder of the loan is $17 plus thousand dollars. I wanted to know what kind of offer in your professional expertise would be a possible point for the credit union to agree. (Possibly offer them $2500 maybe 15%) I understand you can’t predict a response but I wanted some form of guidance prior to me offering them a settlement. I am current with all my bills but a hardship is fast approaching my financial situation. Any advice would be very much appreciated.

Do you have other accounts at NFCU?

What does the rest of your credit look like? Do you have any unresolved collections?

Thank you for your timely response Mr. Bovee,

I do not have any other accounts at NFCU. My credit is in decent shape now but still in repair from a 800 score.

I have no other unresolved collections.

I regularly see Navy Federal settle credit card debts that are late 5 months or more at 40 to 50 percent.

This promissory note is a little different, where I have seen NFCU settle lower than that, but back when short sales were being negotiated as an every day occurrence.

I am not optimistic about them approving a 15% settlement. You can start the negotiations that low, but I would want to be prepared for twice, or more than that.

Hello,

I woke up this morning with a text from my bank stating that I had a 0.00 balance on my bank account. Midland Funding garnish the amount of $23,000 on one account and $24,000 on another checking account. I live in Texas and as per Midland Funding I we $9.000 to Sams and Express card and they state they can garnish triple the amount I owe. Can they do this to my personal bank account? I don’t even have these amounts in my banks??? I need your help and assistance

Hi, I am located in California. I have a 5000$ debt in collections. I think the statue of limitations is almost up in February 2020 based on my last payment. The account has been closed and is no longer usable. I read somewhere that in California the statue of limitations cannot be reset if you make a payment on a UNUSABLE/CLOSED account. However I would like to fix my credit and move on with my life although I only have 3000 saved and am in need of a car also. I am not sure whether to pay it now or pay after the statue of limitations is up. I am confused because I also read that if I settle it could restart the statue of limitations.

I’ve been paying a collection agency, Eastern Revenue INC $50.oo when I can; typically once a month ( I have not paid them faithfully). The original debt was with Eastern University for about $11,904. The balance was sent to collections on 12/2011 ,who bumped up the payment to about $15000. I’ve managed to get it down to $12,930. I want to settle the debt as the school refused to give me an official transcript to complete my degree else where and I cannot take anymore course with them. I tried paying $100 biweekly in the begining in an effort for the collector to settle the debt and free my name with the school. But that didnt work. I’ve since got married and fallen on hard times. I can only afford to settle with $2,000. Do you think thats possbile? Please assist. Thank you.

I wish I had better news, but a $2000.00 settlement on a 13k student loan balance is just not likely.

Are you certain your loan with Eastern is private? There are some good options to pursue with federal loans.

Unfortunately, I think it’s a private loan (tuition billed to me because my financial aid fell thru) What are my options at this point?

I do have a $5000. fed loans that I’m also paying down slowly…what are my options with them? I really would like to get back to school and complete my degree. Any information/guidance would greatly be appreciated. Thank you

Nice talking with you on the phone just now.

Let me know how things go with the student loan servicer next week and if you submit anything to the CFPB about student loan payment stress points.

Just for my greater knowledge, and not intending to pursue non payment of cc debts…..What is the worst thing that can happen to a credit card debtor if he or she does not pay credit cards?

I have seen around the net that at least three things can be levied on the debtor in this case:

1) a judgement can be issued on the debtor’s assets such as savings and checking accts or other liquid assets,

2) garnishment of the debtor’s wages

3) lien on home or car equity

I do not know what these things mean. I had questions on each. For example, what are the constraints or rules placed on the creditors placing these items on the debtors? For any of the three listed above, must the amount of the judgement, garnishment, or lien be the same as the amount of the debt? Is interest added to the judgement , garnishment, or lien over time? Are court costs and attn fees added in to the judgement , garnishment , or lien?

For garnishment, does the garnishment need to be a reasonable portion so that the debtor can pay off the regular bills or can it take over the whole paycheck?

any info would be helpful. thanks

I can help you better understand all of those risks if I knew what state you are in. State law will dictate most of the protections and limitations.

This post will have little more insight into what you are looking for: https://consumerrecoverynetwork.com/question/social-security-pension-state-exemption-debt-collector-garnishment/ – if you do not see where your state is covered in the comments on that page, post a comment and include your state.

IL

Court costs and fees are normally added to the balance being sued for.

Interest is charged on judgments as set by the court. State law will generally cap interest. That cap In Illinois is 9%.

Illinois protects 85% of wages from garnishment. You can petition the court and get a hearing to contest any garnishment amount as creating a hardship. If your income and expenses warrant it, the hearing could result in your being partially or fully exempt from wage garnishment.

Your vehicle is protected up to 2400 dollars of value.

Your home equity is protected up to 15k.

Your household and personal belongs are protected up to 4k.

Your bank account is protected up to the amount you would use as a wildcard that would include household goods exemptions.

Illinois is not a great place to be with unpaid judgment debts.

Hello,

I’ve had two credit cards go to a judgement. Is there any possibility of settling? One is for $6000 and the other is for $2000. Should I file Chapter 13?

Thanks,

Phil

Settling judgment debt is possible. How long have they gone unpaid? Are you paying other credit cards and loans on time, and t=does that show on your credit reports? Are there other collections on your credit reports?

Who are the plaintiffs that sued and has the judgments?

Settling judgment debts on credit cards is best done in a single lump sum payment. How much money can you pull together, and over what period of time, in order to negotiate and pay these off?

Thanks for the reply! $6000 judgment is about 2 years old and they tried to attach a lien (although I don’t own any real property). $2000 judgment was this past spring. I have paid off auto loan and have one credit card paid and in good standing. I think there might be a couple small accounts that went to collection but are past statute of limitations.

$6000 judgment is from Legal Recovery Law Offices (Capital One Bank)

$2000 is from Winn Law Group (Calvary portfolio – HSBC Bank)

I have had a job and some stability for the past couple years. I would like to satisfy these debts and willing to gather the lump sums within the next 6 months.

Phil

With the details I have to go on, I would look at accumulating 50% to 60% for the settlements. If they see you as highly collectable you could be looking at 70%.

While there are some exceptions, I generally do not see much productive coming from reaching out to negotiate any pay off amounts, until you have most of the money you will need in hand, or readily available. You could settle one at a time, but that first one could update the court record and your credit report as satisfied, which can sometimes lead to more aggressive collection from the remaining judgment creditor.

Dear Michael ,

I live in Nevada.

Do far only a Target showing on credit report, I have not made payments for almost two years and was in bankruptcy ch 13 for a year with no payments made since attorney never completed the filings it was dismissed in March if this year . So far only capitol management has written a letter…. And the validation I asked for came from Disvover not capitol management … Very odd not sure who is collecting. So far I am waiting to see who comes after me . I would like to work with your debt counselors as I am so depleated after fighting the dishonest attorney for a year in court . I of not have money for settlement now but may after the disgorgement comes if the attorney goes not appeal , which slows everything down . I was told that since it has been two years the credit card companies may leave me alone .

Thank you

Meta

It may be that creditors leave you alone, but they may not.

Discover has not been much for selling their defaulted credit card debts for several years now. They responded with validation directly to you because they likely still own the account (AMEX does not sell debt either). Your validation letter to Capital Management may lead to someone looking at your collectability more closely. What type of collections notices or calls have you received from anyone else?

You will benefit from talking to a specialist, or even working directly with one. Call and talk to one at 800-939-8357.

Dear Michael,

Hello, I have not paid my credit cards for almost two years per advice from a very dishonest attorney who said he could file a ch 11 if I moved out of my home and rented it out. The attorney filed a chapter 13 without my permission and I was in ch 13 for a year no payments were maid since no 341 meeting was attended by me since I did not know I was even in ch 13 .long story short I fired this attorney and am now disgorging fees of over $40,000 between his and new attorney to fight the bad one . My bankruptcy was dismissed in March of this year and so far only capitol management has said I owe a Discover Bank. $5,200. I asked for validation from Capitol management and got a reply from Discover card with wrong amount and cancelled checks from 2008, very weird. No sure who owns this . My

Question is I owe $48,000 total credit card debt wit Discover , a Chase, Capitol one , American Express. Since bankruptcy ch 13 was dismissed do to lack of doing anything by attorney , how likely is is collections will resume ? Most accounts are over two years old? If I get the disgorgement $$$ back I would like to settle but I don’t want to offer if the credit cards and collectors aren’t coming after me. Thank you not sure what will happen or what to do to keep everyone at bay till disgorgement settles in. 8-10 months if it does .

The Chapter 13 may have tolled the SOL to legitimately sue to collect, so you will be looking over your shoulder for collection lawsuits by those creditors that pay close enough attention. What state are you in?

Have you a recent copy of your credit reports? Can you see any debt collector reporting an account, or is it all the original creditors? How about inquiries listed by debt collection companies? Any names you can post will help me get a bead on how aggressive collections will be other than Discover.

Trying to settle a debt with CIBC visa. It is in the phase before it gets sent off to collections. They are telling me that they cant negotiate a settlement until the account is either brought up to date or sent off to a third party and then i can try and settle with them. The debt is for $24,000

mike – How much money can you pull together right now in order to settle this account?

15k

You will be in good shape when settlement time comes. If it is with a third party debt collector, that is just how it is sometimes with this stuff. If you want some coaching on how you may be able to still knock this out earlier, or when it is assigned out for collection, call and talk to one of the specialists at 800-939-8357.

I have recently pulled a credit report and found an old debt that was quite sizable, its was during a long and hard divorce that let me financially drained. The last payment activity was 2009-02 it was a balance of 7,777.00 (7 is no longer my lucky number) It was sold to a Collection agency in 2010. but the collection agency is saying its 18,800+ owing for their interest and fees, its the only collection on my file, and I was not sued, so how should I handle this, Im told if I call to inquire it will update the “last activity” , in a few months the original loan is no longer on my credit list at all as it will be past 6 years. What should I do, and I was not sent anything in writing about the collection, however I have moved since the divorce so they may not have been able to find me, I do see they ran a soft credit report without my consent in 2013

Angela – The date of last activity on your credit report will not get updated by you calling the debt collector that now owns your account. The debt collector can run that soft credit pull without your consent.

Are you in New York? What credit goals do you have that you are looking to accomplish in the next few months? It would help to know the name of the collection outfit in order to assess your risks of them suing.

Is it possible to settle for around 10-15% of the debt with FIA Service? The credit card debt is “charged off” and hasn’t been paid for almost a year. In this case, the card holder is in a nursing home, she has only $45/ month avaialbe from her SS check, she has no properties, and no savings. Prior to defaulting on payments she added 2 authorized users to facilitate buying for her food and other items before going to the nursing home. Now the 2 authorized users have this debt in their credit and are not able to work for many agencies because of the “charge off”.

What we are trying to accomplish is to pay around10-15% of debt on behalf of all 3 users, get them to agree to report “pay as agreed” to all 3 credit agencies, and get them to agree that the balance is not reported on a 1099 to the IRS. Will your group be able to help with this?

Mery – No, no, and no. You cannot typically settle BofA debt with FIA card services for 10 to 15% of the balance. You are looking at something more like 40-ish percent. There are some instances where limited income and severe hardship conditions could result in a better settlement, but I would not set an expectation of 15% even with the right conditions (maybe in 2007 or 2008, but not now).

You will not get a pays as agreed on the credit report.

1099 forgiven debt reporting is required. It is not the authorized users debt though, and it sounds like the actual account holder would be deemed technically insolvent, so probably not a taxable event. Run that by a tax pro of your own to be sure.

Hi, thank you for your site. I have two b of a cards that after trying to get them to work with me to lower my payments, stopped paying . I have called to try to get a settlement or some type of program to no avail. The last call was told they are meeting again on the 5 th of the month , call back. I just want to get a number, What they will be willing to settle for, and what my credit report needs to read to make it better.. My other cards are up to date only because monthly payments are much lower, balances are lower, and I have medical bills not paid. I am on disability, and starting in January my perscription coverage changed to where my meds aren’t being fully covered and co pays are high as are Dr visits. I’ve heard horror stories where banks take over your bank account and freeze them, I. Don’t know what to do? I stopped trying to pay to attempt to get their attention because they wouldn’t work with me on lowering my payments, The total amount between the two cards is 12,500. I can sell some things and scrape up about 6000.00 .how best to use it. Thank you for your wisdom! Kathy

Kathy – The answer to what type of debt relief you can seek with BofA can vary. My first reaction after reading your post is to want to know the sum of all of your debts combined – not including those medical bills. But do add up all the medical debts and post that total in a comment reply too. I want to see how affordable a debt management plan might be for you.

That 6k would likely be enough to settle BofA, but I am not sure a deal would get approved if everyone else on your credit reports are getting I cannot know this with 100% certainty, but have no problem telling you they aren’t.

I have 5 major credit cards that I am behind on (2 Chase, Discover, Bank of America, CITI), for a total of about 72,000. I also have aobut 8 store cards that I am behind on. I will be getting a tax refund that will allow me to get current on all my store cards. As for te major cards – I have my house up for sale and expect to make between 20 – 30 thousand profit.

I would like to have a settlement on the major cards, I have spoken Bank America – the settlement abount is about 70% of what I owe. Is this high?

Also, will I hurt my ability to get a settlement if I bring the store cards current?

Thank you

marsha – I would consider 70% as a high settlement on a Bank of America credit card, but there are reasons why settlements can be higher than others. Have you read through the fist stasge debt settlement guide on the site? Start here if not.

Bringing your store cards current is something I recommend doing (if recommendable)early on in the process. If you are more than 2 or 3 months late with all credit cards, it may not be a great idea, as paying other creditors can indeed impact the deals you can negotiate with others. Read this report for more details: https://consumerrecoverynetwork.com/credit-card-debt-to-include-in-settlement-plan/.

I would encourage you consult with a specialist about the timing and targets of all of your settlements (and other accounts). Fill in the “contact us” box in the right side bar and submit. I will get that over to a specialist for you to speak with.

Thank you for the information. I have submited my contact information in the “contact us”

Hello, we have concerns about our Mother. She suffered a stroke back in 2011 and fell into debt. She received a notice of levy for money judgement. Hunt & Henriquez for Capitol One for the amount of $4,725.91.

At this point we don’t know what to do, she tried to get free legal help but she doesn’t qualify. She receives retirement pension (not sure if it’s widow pension or what to call it) Is that pension exempt from garnishment? The form states the garnishee bank. She has an bank account but under another family members name since she couldn’t manage her finances after her stroke. The garnishee bank is Chase as it states on the form.

We haven’t filled the exemption form yet. We were told within 10 days from the day it was mailed and then someone else told us it’s 15 days.

She can’t afford the money to file for bankruptcy but we were hoping to pay monthly payment plans with the creditor, if that’s possible.

I’ll take a look around the site! I’m sure the answer will be there too but it would be nice to get feedback. Thank you!!!

Robert – Before agreeing to any repayment plan, request a hearing regarding the garnishment exemption. What state is she in? Do you have power of attorney?

Thank you for the prompt response! I appreciate it!

She lives in California and I currently do not have power of attorney. Should I consider it now?

I will look into the hearing, in the meantime, I don’t need to fill the form out they sent to her for the exemption?

She’s worried they will take her pension as that is used to pay the mortgage.

Robert – Many pensions are protected from garnishment based on federal laws. State laws may protect more, but consult with an experienced debt defense attorney about that. You should also ask the attorney about the forms. The exemptions are often calculated based on income and expenses, so different for each person.

I am being sued for 3186.69 by LVNV Funding LLC for a credit card with Credit One. The last payment I made was 10/6/10 and the balance was 1492.79. I was unemployed for 2 1/2 years and my unemployment compensation had expired. I now have 14 days, as of yesterday, to send my answer to the court. This credit card was one where you deposited money to rebuild credit after being widowed. What do you advise. I live in Texas.

Andrea – Do you have any cash resources right now?

Hi!

I thought I posted a question last week but looks like I forgot to hit the “send” button so lets try this again. Here is our situation:

This is our current debt situation:

1. Care Credit /GE Bank = Total debt = $382 = Last payment 8-8-13

(Was sent to Allied Interstate Collections on 10-21-13 but still getting statements from Care Credit?)

2. CititBank =Total debt = $1,152.14 = Last payment 7-15-13

(Recieved a settlement offer letter from them on 11/30/13 for $576.07. I didn’t have the money together at the time so do you think I could still negotiate this with installments?)

3. Capital One #1 = Total debt = $914.91 = Last payment (not sure but this account was sold to Capital One from HSBC) but got a letter that I am 6 payments behind & threatening a charge off on 12-23-13 which is now past…

4. Capital One #2 = Total debt = $2,189 = Last payment = 7-23-13

5. Home Depot = Total debt = $6,070.70 = Last payment 8-5-13

I was laid off 1.5 years ago & when unemployment ran out in August (earlier than expected due to our state falling below the unemployment limit) I wasn’t able to afford all the payments + the new medical debt that we accrued having a baby in June. Fast forward 5 months. I have about $800 saved to help settle some of these debts. I am also anticipating a tax return this coming year that will hopefully cover the remainder of the settlement money. Since I don’t know those numbers quite yet, I am a little hesitate to start negotiating with all of my creditors. So, I have a few questions before I attempt to do this:

1. With the $800 I have now, how should I prioritize which creditors to settle with & for how much?

2. From what I have read, it sounds like 50% is what I should anticipate if the creditors are negotiable & accepting settlements. Should I start my negotiation lower like 30% or is that unreasonable?

3. Who specifically do I need to speak with when I make a settlement call? Do I need to request a manager right away?

4. I am really nervous about the Home Depot account. I am really keeping my fingers crossed that I can use my tax return to settle this. How much time do you think I have on this account? I am hoping to have my tax return figured out late January….

Any advice would be extremely helpful.

Thanks so much for your time!

-Lis

Lis – Sorry to have missed your prior questions. I was able to locate your original submission and am going to publish that as a new page with my feedback. You should get an email notification and link to that new page when it goes live, and we can correspond in the comments of that page after that (I have some follow up questions for you).

Hi,

I am looking to settle my accounts with b of a is current at $6000, chase cards at total of $ 9000, a capital one card at $3000 and a citibank card at 3000. My bills are all up todate however I have been unemployed for over a year and have a few about 10000 in savings. all i’m wiling to spend just to pay these bills off so I can have some peace of mind. I am suffering from major depression and do not need creditors hounding me about bills. I have offered bank of america $2000 as a settlement but they refuse to work with me. I was on the payment protection plan over a year but that has now ended as well as capital one’s. I am at currently behind on my mortgage so I’m just trying to do my best here. any help would be appreciated.

tina – Using settlement as your debt relief option I estimate (on the high side) you would need about 8900.00 to settle with those credit cards. You would not be able to settle while current, or even when you are only late a month or two. But you would likely be able to hit those settlement targets prior to 6 months of delinquency, based on today’s trends. This is why you are not getting anywhere with premature negotiation efforts with Bank of America.

How much are you behind on your mortgage? What is the reason for being behind? I can offer more feedback about settlements, and other debt relief options, if you can post a comment reply with answers to those questions.

I am currently dealing with MCM. This debt was originally with Chase and sold to MCM. My last payment to Chase was 9/31/09. The original debt was 14K

I sent them a debt validation letter and requested my signed contract and a few other items and they sent me 3 bills with Chase’s letter head with a date of 2/10, 3/10 and 4/10 and stated here are the items you asked for. I have never seen those bills on that date it looks like something they just made up.

Do I have to send them a letter back stating I still do not recognize the debt?

Thanks

GC – I am not quite sure I understand your question about sending another letter. You appear to be saying you had a debt with Chase, but are not able to recognize “this one” that is being collected on as yours?

If it is yours, debt validation is pretty simple for collectors to meet. Not sure where you heard you would get a signed contract back.

What is your goal with this?

Hi Mike,

Thanks for the response..I am just trying to understand all this and what I should do to get the least possible settlement.

I just thought they should at least send me a signed contract. I had other debts that filed suit against me and each one attached the signed contract so I just figured they would also when they returned the validation. Is the signed contract just needed for a lawsuit?

I went thru a divorce back in 2009 and right now I do not have the money to settle but would like to try and work out a settlement so I need to try and settle for has little has possible. Now that I got the validation letter back can I start to settle?

Thanks again

Gabe

PS I would borrow money to do this..

Hi Mike,

You asked what are my goals..Has I stated above I would like to settle but do I have other options? Again just trying to understand all this and what options I have when I debt collector purchases from the original creditor.

Thanks

GC – Generally, requesting the contract supporting the underlying debt is something that would become part of defending a lawsuit, not a typical validation request. There are a couple of states that define what constitutes validation more clearly than federal law (FDCPA). Massachusetts is one, California (for debt buyers) another starting January 2014.

If you recognize the debt, you do not have to send a debt validation letter before you try negotiating a settlement. Depending on the circumstances you can actually complicate the process. If you are still dealing directly with Midland Credit Management, and not an attorney debt collector, than settling now will often bring a better result. Midland settlements can be paid in a lump sum, or over a period of months too.

What can you come up with for settlement?

Are you still dealing directly with MCM?

I ask about goals because the answer I get back helps me focus sharing my experiences and those of consumers. If you wanted to buy a house in 6 months, my feedback would be different than if you said you are trying to compare settling with filing bankruptcy for debt relief. I also read comments and try to determine if someone is trying to work through debts by resolving them with available resources, or when someone is just stuck between a rock and a hard place (wants to resolve, but no resources).

Hi Mike,

I would just like to settle this.

I am dealing with MCM directly. They did offer to settle for $7.8K( after 1st call) but I just don’t have that kind of money right now and hate to go into a payment plan because my resources are low at the end of each month but will if I can’t get them to go lower.

Should I just state up front I need a payment plan or will that reduce my changes for getting a lower settlement? Right now I only have the ability to get 2K..

Thanks

GC – The payment plan option is going to likely be how this gets done. 2k as a lump sum on a balance like this is just not common. I have seen the amount agreed to settle go up a bit when longer term payments are needed, but not by much. The terms can vary and are situational. If you want help, consider calling in and talking with a CRN specialist at 800-939-8357 ext 3. But only after first giving this a go yourself. How would it look for your monthly budget if the roughly 8k was spread out over 18 months?

Hi Mike,

This is what I settled for on other accounts that filed suit..

American Express, org–>$20K settled for 7850 made in 2 payments

Capital One org–> 29K settled for 11K made in 3 payments

Bank of America–> 15K settled for 6.7K made in 2 payments

and that basically cleaned me out. So I am tapped right now

for funds to pay even a monthly payment..I was hoping to at

least settle for 5K. 2K up front then make payments for 1 yr..Do

you think I can?

I am stuck here but I guess I need to talk to them on Monday..

GC – That was a great settlement with Capital One. Good job on the others too.

Offering the 2k upfront may make the difference in getting that settlement approved. I tend to respond to these types of things with generalities for 3 reasons:

1. Not knowing the personal details that I drill into as a professional in order to best target settlement percentages and possibilities.

2. Most people will not want to provide that detail publicly (even anonymously), and rightfully so.

3. Someone later reading what can be done in your situation, may target the same result, but fail because each file can be looked at differently.

Having said that, you already have those settlements under your belt, so your going to approach this with a higher degree of confidence. I have indeed seen settlements get put together consistent with what you are targeting. Your profile will need to match the type where those are approved on their end, and you are going to have to communicate your financial hardship well.

Thanks Mike,

Well I don’t have anything they can take..No house, but I do have over 100K in school debt and I am sure they see it in my credit report and a car loan.

I will give them a call on Monday and see what I can do.

Thanks Mike, I will post how I make out.

I’m current on all my accounts owe about $30,000 total to two different BoA credit cards. Would love to settle these! We’ve never missed or been late on payment but only pay min and now we are struggling to make the min. Would love to settle and be done if possible. What do you think our options are? Do we have to be delinquent before we can approach for settlement? Thanks for your advice.

Elizabeth – What are the interest rates on those Bank of America accounts? What credit products do you anticipate applying for in the next 24 months (home loan, refinance, auto loan, student loan)?

You absolutely have to be behind with payments on the credit cards before a debt settlement is possible.

Post a comment reply with answer to those above questions and I will be better able to provide more meaningful feedback and compare some options you have.

With the 15% that we need to pay for the professional help, can it be paid monthly since we cant afford to pay the lump sum?

Thank you

Rory – I replied to your question on the credit counseling page. If settling those same credit cards is the way you choose to go, rather than reduced monthly payments, yes, all of the specialists in the network do agree to spread out the fees after your debts are paid. I had a large file I worked on where my fees were spread out over 2 years after all the debts were settled and paid. It is up to each individual specialist as to how they set that up.

Hi, I am new here and trying to navigate my options. I would like to try to do this with guidance but to the brunt of the work myself. Not sure if that is the best idea though.

I have about $40,000 in credit card debt, spread among Discover, BoA, Wells Fargo and Chase. We haven’t paid any of them in over a year and were planning on filing bankruptcy. We are now re-considering due to my husband’s job and want to see if settling is a better option. We just received letters that two of our three BoA loans were sold to a debt buyer, Portfolio Recovery Associates.

We are trying to determine if we can still attempt to settle with them, and how to go about it. We do have some cash we could use to settle immediately if they would accept about 30% of the balance.

We recently settled our second mortgage with Green Tree because of some cash given to us by a family member. I am not sure if knowledge of that settlement impacts the credit card accounts.

Any advice on what to do to proceed would be appreciated. We do not have any experience dealing with negotiating credit cards.

Lisa – If you have enough cash resources to settle all of those unpaid bills, than working with Portfolio Recovery Associates, and those collection agencies that have your other accounts, is going to be a fairly straight forward process. If you are limited with funds to the point that you have to target which accounts to settle now, and which to settle a few months from now, and a few months after that, than targeting which ones to do first is important. Settling with PRA is common, but you may want to target some of the other accounts first.

Who are the other debts being collected by right now?

I would suggest calling in to a specialist for a consult. You can work one on one with a professional to help you through the negotiations and settlements on each account. You would also be able to better target realistic offers to maximize savings. Call 800-939-8357 ext. 3 to speak with one.

Thank you so much Michael. The only accounts that are attempting to collect right now are the two with Portfolio Recovery Associates. The remaining debt holders have not contacted us in about 6 months. We do not get phone calls or letters or statements of any kind. But we didn’t get any correspondence in months on the two now with PRA either, until we got the letter saying they had been sold. And the letter we received from PRA did not actually mention a lawsuit, just that the account was sold to them and a number to contact for payment. I’m not sure if that is usual or not. We expected to receive calls, etc on all of these accounts, but instead get nothing. I’m not sure if that means the others are in the process of being sold. Most of these accounts did know we were planning to file bankruptcy (and had obtained a lawyer), but all of them knew we hadn’t filed yet.

We definitely want to head these off before anyone files a lawsuit though. So, I will definitely take your advice and contact the office tomorrow to speak with a specialist.

I started getting into trouble about a year ago, due to my work hours being reduced. Started to get behind on many of my credit cards.

My wife and I started a plan with a Consumer Credit Counsuling Service. All of the creditors reduced our interest rate and participated in the plan. To make a long story short, I was out of work for a month and we fell behind in this also. All of the creditors except ONE kept our interest rates low and has not been charging us late fees. We have 3 credit cards with this ONE creditor. We are behind, but may be able to bring our accounts current in the next month or two. (Except for 2 accounts with this ONE creditor as these were “charged-off” some time around January of this year.

QUESTION: Will we have a harder time negotiating a settlement if we bring the other accounts current? I am back to work full time now.

QUESTION: We have no cash on hand or savings, how best to negotiate a settlement in installments for the charge offs? Is this a possibility?

Jeff – I have some feedback that will help you evaluate your options and some realistic expectations. I want to be sure I understand your current situation first.

You have a total of 3 accounts that are not currently being paid through the debt management plan you are on with CCCS. All three are with the same creditor.

2 of those 3 accounts have charged off. One has not.

Who is the creditor?

Who are the debt collectors that the accounts have been placed with?

Michael – Thank you for your reply

My apologies for not being clear. We are no longer enrolled in the CCCS Plan, but our creditors are still honoring the reduced rates. We pay all creditors direct.

Regarding the seriously past due accounts. I did send about half of the delinquent amount to the THIRD account, at the end of last month. I actually sent a small amount to the TWO others about two months ago, which was reflected on the statements that they are still sending.

The creditor is CitiCards and the collectors are “Client Services, Inc” and “United Collection Bureau.” The latter, with a current offer for 50% of $7,254. (We just don’t have the cash right now.) – Jeff

P.S. I haven’t picked up the phone yet. (I am about half-way through your very helpful videos and I understand NOW, that I need to start talking with them.)

More info:

Mortgage – 30 days

Auto – Current

Home Equity – Current

11 Credit Card and Unsecured Accounts – All but above are Current or Almost Current

ADDED – Correct TWO charged off, THIRD is not.

No offer from “Client Services, Inc” for the $3,320 account.

With the additional details you provided, it is unlikely you will be able to settle the charged off accounts for the optimal savings and still meet your need of affordable monthly payments being agreed to. It may be possible to get a 12 month payment, along with a less than optimal balance reduction, but that is not always an option. The fact that many other accounts are being paid, while citibank is not, does skew a collectors view, and sometimes in a way that cannot be overcome.

If your up to speaking with me so I can delve a bit deeper into income and other accounts, I may be able to make some suggestions on how to proceed from here. You can send an email reply to the comment notification you get with this comment. We can set up a time that works from there.

I used my personal credit cards for my business and accumulated over $100,000 credit card debt, and I have been fallen behind paying my billl due to busines slow down for the last 6 months. I have been always struggle for making the monthly payment in the last 2 years but never missed a payment until the last 2 months.

My business also have bank loan and credit line bank such as Fremont Bank and Wells Fargo.

I found credit card companies are less demand on chasing my payment than the banks that they will call my home 15 days after I late to make my payment, while the credit card won’t call me after 30 days later. Also credit card is very willing to offer hardship program yet the bank does not offer any help rather than immediately payment.

Now I realize I have to face the fact that I need to work on the debt settlement after serveral year struggle making the monthly payments. However, I do not want to take the BK approach as I have a house and this approcah will very hurt my family.

Do you think I am still able to negotiate a debt settlemnt (reduce the debt amount) while I own a house? Is it easiler to negotiate with credit card companies or bank (loan)?

Thanks

Patrick – How easy it is to negotiate and settle bank loans and credit cards is relative. Each persons stress level associated with debt settlement will vary. The more you know about each one of your creditors, and how they try to collect – up to the point they are willing to settle for the best savings – the better you will feel about the whole debt relief process. It is not that one debt is more easy to settle than another. It is more about each banks internal practices for collecting, which can change with different loan types. Settling a line of credit or bank loan with Wells Fargo is a good example.

You can settle debts when you own a home. You can also still file bankruptcy with a home. Having a good amount of equity in your home will have implications for chapter 7 bankruptcy. But many people are able to keep their home while still discharging unsecured bank loans and credit card debts.

I encourage you to call and speak with a specialist to drill into all of the details about your situation, the creditors and balances you are dealing with, and how to set yourself up for success: 800-939-8357 ext 3.

Thank you. I will call and speak to a specialist this week.

Patrick

I have 3 credit cards in hardship payment program, but I have problem to make the monthly payment, can I go back to ask to re-work on other payment terms. What is next action the credit card companies do if I can not make those payment?

Hardship payment plans offered direct from credit card lenders are often offered based on how they view your account. If the banks internal systems suggest your payment be reduced to xxx amount, that is normally going to be the limit of whats on the table. This type of plan cannot be amortized for more than 60 months, and the monthly payment reduction is the result of lowering your interest rate on the card. If this lower payment is not affordable, calling in to ask about a further reduction of the monthly payment is certainly an option, but one is not often made available. What were your interest rates on these specific accounts reduced to?

If you cannot continue to make payments on time your accounts will become part of the normal collection process each bank has.

I understand your fee for direct settlement services is 15% of SAVINGS. This is very fair when taken off the initial debt. What may be a large unknown is the accumulation of late fees and interest over the length of the negotiation process. If your 15% savings is off the ultimate total then this percentage will increase substantially in dollars. How do you approach this?

In general I have $50,000 in credit card debt, 4 cards and am current, with Bank of America holding most of the debt ($35,000 ) and unfortunately $6,000 with Discover.

Joel – If a CRN member enrolls with the expectation that a pro will be offering a direct debt settlement service – the fee is based on the balances at time of enrollment. This is typically going to be a scenario where someones debts are seasoned enough to settle (generally debts have not been paid for 120 days or longer), and who has money available to fund negotiated offers.

Our primary goal with our members has always been to show you how simple it can be to negotiate and settle debts with your creditors yourself. Many people have enrolled over the years because they want someone else to get the debt relief and balance reduction for them, and our 15% of savings fee has been the fairest in the industry for nearly a decade. Even though direct services mean we get paid more, we have never softened our position that you can do what we can do just as easily – if you knew what we know. By sticking to our core mission of educating people to settle debt on their own, close to 80% of the settlements with CRN have been done by our members using our education and ongoing support. DIY debt settlement works. Especially with Bank of America.

I have quite a bit of medical debt due to a car accident that left me out of work for a couple years. I’m hoping to get out from underneath that now that I’m at full health, but I hear a lot of conflicting advice. When these issues are paid, whether settled in full or on a lesser amount, will these then reflect as paid but stay on my credit report for another full 7 years? And how much more favorably would a potential lender or credit card company view a paid blemish on a credit report than the alternative?

Colleen – When you settle an old debt and that fact gets updated on your credit reports, it does not breath a whole fresh set of ten years int the reporting. The 7 years will still timed from when you first missed payments to your lenders.

The credit report benefit from settling old debts can vary. You are not really getting a credit score bump from the act of settling. You are getting accounts updated to reflect a zero balance owed, and this will often be the point in time your credit can begin to recover. It will bounce back quicker or slower depending on a host of details. In today’s lending environment, you will have a far better chance at being approved for new credit once your collection accounts show paid (whether settled or paid in full will not matter with debts a couple years old).

You can get into much more detail by calling in to CRN for a consult: 800-939-8357 ext. 3.

Thanks Michael! I appreciate the response. I will likely be reaching out sometime soon.

I am trying to settle a debt with a collection agency, Greater California Financial Services. The original debt was from wells fargo credit card. The debt was for about 9K, but with all the collection agencies fees they have a total of 11K. This collection agency purchased the debt. Prior to debt going to them, wells fargo was willing to settle for 4K. I should of acted on this, but I did not have the unfortuantely funds available at that time. I have spoken to the collection agency rep, and he is not very negotioable. I offered 2K and went up to my peak of 4K to settle this with them and the lowest they have gone is $7500. They seem very difficult do not seem willing to budge. I do not know what to do at this point… Any feedback would be appreciated.

Claudia – Settling debt is a fairly predictable process. More predictable with major credit card issues like Wells Fargo, than with debt collectors and debt buyers like Greater California Financial Services. My feedback would be more meaningful if I knew the answers to the following questions:

When was your last payment made on the Wells Fargo credit card?

Are you making timely payments on other credit card debts right now?

In brief, what was the hardship that caused your inability to keep current with payments to Wells? Do any of those, or additional hardships persist today?

Post a comment reply with your answers and I can better assist from there.

Last payment to wells fargo maybe mid 2011? was sold to collection by may of 2012.

Yes I am making timely payments to all my other creditors.

Yes due to financial hardships (lack of income, spouse unemployed, medical/insurance costs, insurance/medical bills etc.) My mistake was I took out this credit card to merge my then existing credit card debt & then I couldnt keep up or make payments. Everything is pretty stable at this point, working on getting my finances/credit in order.

Claudia – If you are making on time payments to other credit card debts, just not the old Wells Fargo account, GCFS can see that by real time access to your credit report. Debt collectors are not as open to discounting a payoff or settlement when they see that.

I see a couple options for where you go from here:

1. Continue to work towards your settlement with Greater California Financial Services and hit a target amount they will accept and that you can pay.

2. Work with someone like CRN or another affordable service provider to get this done on your behalf. There are instances where a pro can get something accomplished, or hit a savings target you are struggling to get for yourself (mostly this applies to collection accounts like in your case).

3. Bide your time until GCFS sues in order to collect (they do sue). If they sue, defend the case with the help of an experienced attorney.

Those are the realities I see given the limited information I have. I would not suggest bankruptcy given you are able to settle, but just need to hit a better target.

You are welcome to call in for a consultation to take the discussion further. You can reach a CRN specialist at 800-939-8357 ext. 3.

I have lived in Michigan for the past 2 years after living in Washington DC for 2.5 years before that. Before that, I lived in California. I recently was encouraged by my bank to take a look at my credit report for some “irregularities”. I pulled a free credit report and learned that I had a civil judgement entered against me in California in February, 2011. I had a friend in CA look into this and apparently service was delivered some time in 2010 to a Postal Annex where I had received mail for about 9 months back in 2009 just after leaving the state.

This was for a credit card that I had registered with a debt settlement company, for which I had paid monthly for two years during this time for the settlement company to negotiate on my behalf. So, now, I apparently have a judgement looming out there, with me first knowing about it after the 2 year SOL has passed to file a Motion to Vacate for improper service (I truly didn’t know about this judgement until about a week ago in 2013). And, the debt settlement company takes no responsibility for any of this. What should I do? Can I wait until an attempt is made to move the judgement to Michigan and file to vacate then? Or do I try anyway in California? Or do I figure out who owns the debt at this point and try to negotiate some sort of settlement?

Thanks.

So, now my question is as follows:

Elizabeth – Who was the original creditor? Who sued if other than original creditor (name of plaintiff on the lawsuit)? What is the balance of the judgment? Are you still working with the debt settlement company in any way?

Post your answers to those questions in a comment reply and I can better provide feedback to consider.

First…thanks for providing this fabulous resource. I am at the point where I have to face doing something and I am seriously thinking about trying credit card settlement rather than management.

However I have a question that I can’t find answered anywhere.

If I choose to settle with my CC’s and they agree to an amount I understand that the part that is not paid by me has to be turned to the IRS at tax time.

I may or may not fall into the category of having to pay taxes on this as income if I am involvent. I do understand that….however I am also on Social Security. I can only earn just over 14,000 a year without being penalized by them taking 1 dollar for every one I earn after that initial 14,000.

Will Social Security look at this as the kind of income that they can take one dollar for every two? If so…settlements would never work for people on SS because they would get crushed the next year.

Let’s say I settle 50,000 total in dept for 30,000. That leaves 20,000 reported to the IRS as income…I may or may not be taxed on.

But, how does the Social Security view it? Is it viewed as regular income that they can collect on or does it fall into some category like pensions that they cannot call income they can collect 1 dollar for ever 2?

Thanks for your response ahead of time and for all the valuable info you are providing!

Kathy D

Kathy – In general Social Security looks at wages/earned income. Forgiven debt would not meet their definition of that.

I called the social security administration as a result of your question looking for a definitive answer to share with you. Without you on the line to discuss the particulars of your situation, I got the general information I would have offered without having made the call. In order to get the direct response you need in order to best evaluate what you do next, you should call: 800-772-1213 – Be prepared for a little bit of hold time.

Also, while not part of your comment, I should point out that chapter 7 bankruptcy may allow you to discharge the credit card debts without any portion being considered taxable.