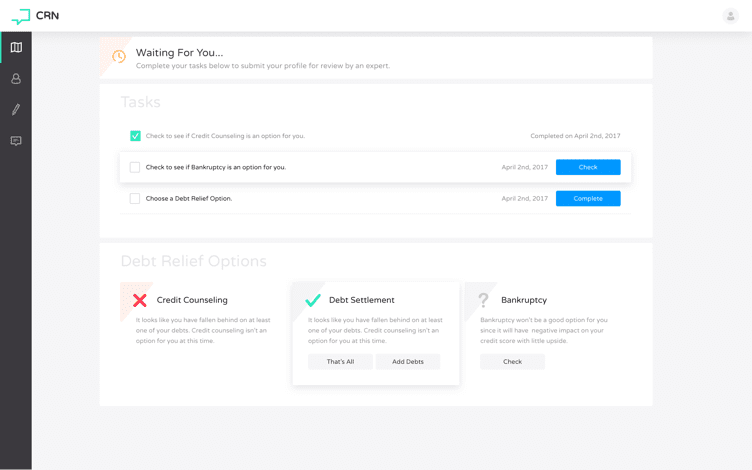

Quick, Easy and Free!

Get started by filling out the form below. You will then be able to schedule your phone consult for the day and time that works well for you.

Quick and Helpful Consultation

Sometimes all it takes is answering some easy questions and we can show you the debt relief path best for you.

Connect Directly with an Expert

Have a question or looking for additional guidance? Our debt relief experts are here to help you through the process.

Custom Debt Relief Plan Built for You

During your consultation, our experts can often offer actionable feedback specifically designed for you.

Consultation Request

Fill in the information below and submit your request in order to schedule a time to consult with your debt expert, Michael Bovee. The more information you provide, the more I will be able to hone in on helpful feedback, rather than gathering details you can provide in advance using the form below.

Hello,

I was served yesterday at my father’s address a warrant in debt.

They have attached a bill (account statement), a bill of sale and assignment, Exhibit 1 Asset Schedule, Affidavit of Sale of Account by Original Creditor (to Midlands Funding LLC), Certificate of Conformity, Field Data (with Balance -$1710.80, Charge off date Feb 10, 2010, Last payment Amt $54.00, Last Payment Date Aug 13, 2015, Last Purchase amount $1,100, Last purchase date June 12, 2010, and my personal particulars), followed by another account statement with larger balance after interest accumulated, and finally an affidavit from someone at Midlands Funding LLC stating they would be willing to testify against me to collect the debt i guess.

Do i stand a chance? A Bill of Particulars doesn’t make sense at this point since there is some proof that i was paying on the account at a point in time? What can you advise? Should i simply pay it? Or do i have a chance at beating it? The court date is Feb 28th, 2017. Please advise

I am interested in settling if it cannot be dismissed. Court date less than a week away.

If I wanted to stand a chance at winning I would hire an experienced debt defense attorney. But the issue here will be the cost of doing that. You could pay more in attorney costs than what you owe, and certainly more than you could settle for.

I can email you list of NACA attorneys with the experience you need if you like? What state are you in?

Hello Michael i got a judgment in the mail from Midland from a chase card that i dont know about. I did have a chase card in 1998 that i couldnt pay but that was 18 years ago . they said the judgment was open since 2009 and i have 30 days to respond or they maybe subpeona me. Isnt this debt already to old for them to come after me?

Let me give you a little info on the chase credit card debt they gave me a card in 1998 for 5000 dollars credit but now 18 tears later midland says i owe them 15000 can i just call chase and settle with them or pay them.

Midland is a debt buyer Chase would have sold the account to. Chase is out of the picture at that point.

Judgment debts have a different shelf life, so quite likely no, the debt has not expired as a judgment. In some states judgments can be renewed forever.

What state are you in?

I received a summons on January 29,2017 for a debt owed to Capital one. I wanted to know what my options were in settling for 50 to 60 % and avoiding the courts all together?

The attorney is from Cooling and Winter, should I get an attorney as well?

I can pull together money within 60 days from my income tax but again I want to settle the debt and avoid a judgment

I would suggest defending the lawsuit to both buy time until you get your tax refund, and to create a more pliable debt collection law firm. I can email you a list of experienced debt collection defense attorneys if you like. What state are you in?

I’m in Georgia and I would like you to email me the name of attorneys please.

Background information:

Divorced in Feb 2007. Received a Capital One account that was in my name with a balance of $9300. I received several other accounts, but all have been paid off normally. This is the ONLY one I need assistance with. I have no other debt except my car. I rent. The minimum payment for the Cap One was too much for me. I immediately called Cap One and explained my situation. For the next year, I made $50 payments mostly with a $297 payment once “to keep from charge off”. In March 2008, the account was turned over to United Recovery Systems. I arranged with them (and they accepted) that they would draft my checking $50 each month. I know it’s a small amount, but I needed to be safe at the time. With monthly interest charges offsetting my payments, the account grew to $13,500. But everyone was apparently satisfied. Over time, I made periodic requests by letter to settle with X amount. None were accepted. About June of 2012, they reduced my interest rate to 0% !! This was of courser greatly appreciated. Now, my $50 payments were slowly reducing the balance. In March 2016, I got a letter from Cap One that they were going to service my account again. Drafts continued to October 26, 2016. As I reconciled my checking, I saw that the $50 draft wasn’t coming through. When I reconciled for Feb 2017 and there still was no draft, I called the number on the March Cap One letter. I told Terie that, though I would love for all this to disappear, I wanted someone to know that the drafts had stopped. I did not want to get in trouble. During my conversation with Terie, she put me on hold and returned with a $5,775.11 settlement amount on the $11,550.22 balance. (50% as I’ve read on your website). I countered with $3,000. She put me on hold again…returned with $3,500.00. I have 30 days to consider this. Part of me should accept the $3,500. Another part wants to say $3,000 is the best I can do. Now is where you come in! What should I do? What statement/letter of the settlement should I expect? WHEN should I require it? I understand the 1099C requirement of the difference, but I read on your website that I won’t necessarily have to include it as income. How do I know one way or the other in my case? Terie said they would report to the credit bureau(s) of the settlement. My credit score is 803. I see NO mention of Cap One on my reports. Aged off? Will this report of settlement affect my excellent rating/score so that I’ll have to regain it over time again? Will they report for sure? I like your suggestion of opening another checking account at my bank with just the settlement amount in it. I’m going to do that this week. I was thrilled to come across you and your company in my research on how to proceed. HELP!! Thank you.

A single account is not generally worth opening another account at your bank, or at least I wouldn’t in your shoes.

I would not want to lose the deal by holding out for 3k. Not when you already have them at the low end of what is typical.

None of this should show on your credit reports, including the settlement. The account already aged off and cannot be placed back on there. If it does it will be a mistake and can be fixed quickly. If that happens post an update and lets go from there.

Talk to your tax pro and determine if you are seen as technically insolvent. That is the way you would avoid tax on forgiven debt. But even if you owe tax next year, it is still better than the alternative.

Thank you very much!! One question…do I get a letter/email from Cap One FIRST detailing that this is a settlement in full and then make the payment? Or do I trust the agreement in whatever order and I’ll be finished with Cap One? If this is described on your website, just point me to it. Thanks again for your quick response and assistance.

Check out this article about getting your settlements in writing.

I was contacted by portfolio recovery associates about a few capital one accounts that were in my chapter 13. My chapter 13 was dismissed but apparently capital one sold my debt to portfolio recovery associates. This is not showing up on my credit report and I was wondering if entering into an agreement with them would negatively affect me credit report. Is this wise to do and should I negotiate a settlement agreement? If I settle with them would this affect my credit report. I do not have any judgement against me for them

You should assume that any settlement you reach with Portfolio Recovery Associates is going to appear on your credit reports.

I would look to settle with PRA at around 50% of the balance still owed, and in a lump sum payment.

Hello, I was served papers today on being sued by Jefferson Capital Systems, who purchased a Loan from Sallie Mae. The amount is $9000. I am looking for an attourney to help defend me in this case. Do you have any suggestions? I am located near Herkimer, NY.

I sent you a couple dozen. Match up the city nearest you and start there. There are instances where distance from the attorney you work with won’t matter.

Hello,

I’m looking to buy a home within the next year, and I have spent the past few years working to improve my credit score. I had good credit until the financial crisis of 08, at which time I lost my job and fell into debt.

One of my debts from that period is from an old Sprint account. The account was eventually closed, then moved into collection. When I was financially sound enough to make payments, I was advised not to because the collection would fall off my credit report within a year, and that I should take care of other debts instead. I took the advice, and that particular collection did fall off.

Today, I received a letter of collection from a different collection agency for that same Sprint debt. The offer states that I can make a settlement payment to clear this account in full. The offer is a 65% discount of the original debt and seems like a really good deal, I decided to do some research to make sure I wasn’t falling into any loopholes that could cause problems, and read a number of articles that claimed paying the debt could be bad for my credit score. I thought I was being proactive in researching for a solution, but now I’m more confused than when I started… Please help!

Thank you,

Josh M.

It sounds like the debt is too old to appear on your credit. If that is the case, paying it now will not change any of that. You can resolve the debt if you like and know that it will not hurt you. If it does, post an update and I will help you from there.

That’s what I thought, but I wasn’t sure. Thanks for the assistance. I’ll circle back if the debt pops back up on my credit report.

Thanks again for the help,

Josh M

Hello I have a court date this month. I have disputed this debt because I am unsure if the charges are mine or valid. I am being sued by midland credit and the original creditor was credit one. I have asked multiple times certified mail for them to send me a statement with the breakdown of charges. The statements they send are only 4 months with no detailed charges. The reason I’m asking for that is I never lived at the apartment they have in these statements, I have had utility bills in my name that at this same apartment that were not mine and I want to make sure that the charges to come up with the $1499 balance is mine. I have no issue trying to pay what i owe but I am not in a good financial spot to pay $1500 and it’s not my charges. I honestly don’t remember the balance owed bc this was a time I had and closed the account when I was unemployed. How likely is it that they can prove the debt is mine or produce a detailed statement. Are they required to? And can they win a case with 4 statements and what looks like a credit card printout with my social blocked out ?

Please help. I’m thinking of possibly getting a lawyer bc I am stressed about having this public record on my records . Is that an option.

I am in md . The attorney is in Wyoming . What are the chances they show up too?

And the last date of payment they are showing is August 2014

I would suggest you call in for a consult. I have many questions for you before I can offer actionable feedback. You can fill out the consult request form above, or reach me at 800-939-8357, option 2.

I had a credit card balance of 8500 that I couldn’t pay and it went to court and citibank was awarded the judgement against me. The last payment on credit card was in 2006. They were awarded the judgement in 2008. It’s now 2016 and they have not garnished my wages or my checking account. It is no longer on my credit report. Why have they not pursued it? I would like to try and settle the judgement for a lesser amount. Is that possible

It is fairly common to settle judgment debts for less than what is owed. I have several cautions before you do though. You are welcome to call in for a consult at 800-939-8357,option 2 rings to me. You can also fill out the consult form above and once received I can call and/or email to set up a time to talk.

I was recently served by LVNV Funding which purchased my delinquent CitiFinancial account. They are seeking $3200. Do I contact the lawyer to see if I can work this out to avoid court?

The way to work this out and avoid court or a judgment is by negotiating a settlement. Follow that link to the page I have dedicated to negotiating when sued.

Can you raise half the amount owed?

I opened my credit card on March, 10 2009. After a few years, I couldn’t afford to pay the debt anymore (around $1300). My account was charge off for delinquency on August 5, 2013. And today (Nov 29, 2015), i received a filed lawsuit against me. It was filed on the Nov 12, and I only just received it today, and I have only 20 days to respond (which I’m not sure the since the date I receive this lawsuit or since it was filed). The status of limitation in WA is around 6 years for writing contract, and 3 years for oral. I wonder if they can still sue me after 6 years. Also, could I still negotiate a debt settlement now or is it too late? What are the next steps I should take to be able to negotiate a debt settlement?

The time to respond to a lawsuit generally begins with the day you were served. Talk to an attorney in Washington about this to verify.

The 6 year Washington SOL to legitimately sue you begins with the date you stopped paying, not when you opened the account in 2009.

You can still negotiate a settlement when sued. Be sure to review that page reader Q&A and the many comments for tips about your next steps.

I sent a request for advice on debt help and I am not sure if it went through or not. It was on the consult request form. If it did go through I apologize for the duplicate message. My case is complicated by a few factors, the major being a divorce in which I assumed the majority of debt in efforts to leverage custody issues with children. I am having trouble paying even the minimum payments on credit cards and am behind on my mortgage. I need help understanding my options and what is realistically achievable for me. I have about $40,000 total in credit card bills from about 8-9 cards. I am a single mom who made a foolish decision in effort to keep a divorce from being drawn out and expensive…. Now I am worried I will lose everything.

I sent you an email and left you a phone message this morning Penny. I look forward to hearing back from you.

I have a single debt to settle with Key Bank. I took out a loan with them to purchase a new boat in 2003. In Oct.2005 I stopped paying on the boat and filed bankruptcy. A little later I dismissed the bankruptcy and settle all of my debt except the boat. Key Bank repossessed the boat and sent me to collections. They currently show the last payment at Sep. 2010. Since 2005 I have completely restored my credit with the exception of this debt. Now that I am trying to purchase a home the banks want this debt settled. On my credit report it shows written off and charged off. Is this debt outside of the statue of limitations, and is this something that could possibly be settle for pennies on the dollar?

When was it you last paid anything on the boat?

I last made a payment in 2005, however they are reporting my last payment as Sept. 2010.

I would dispute the entry as too old to remain on your credit reports after you read this article on the topic. Send the dispute in writing and use certified mail.

If the reporting agencies do not remove it on the first effort, post an update and I can help you from there.

It’s quite disturbing when you call the 800# and after giving your info, be told that you can talk to someone 10 days later as that is there next available time to talk to someone.

Mel – Are you talking about calling CRN and being told to wait 10 days before you can have a consult? That is not possible.

What number did you call and what extension did you choose? Do you know the name of the person you spoke with?

You are welcome to call me direct at 800-939-8357, choose option 2. If I cannot answer your call be sure to leave a voice message and I will get back with you promptly.

Do you provide services in Canada?

I have helped people settle unpaid debts in Canada. What is the situation you have going?

I have some related content up about dealing with credit card debt in Canada.

I need some advice, I was serve with a summons to respond to a complaint by filling an answer to a court and paying the court fee, they said I could defer the court fee. I have to answer about a credit card in 20 days of receipt of the letter. The plaintiff is Midland Funding the amount is $11,000. What advice can you give me?

What is your goal for resolving this?

Are there other unpaid debts out there?

Who was the original creditor Midland Funding purchased your debt from, and when did you last pay on the account?

What state are you in?

Your posting this comment on the request a consult page. Were you wanting to set up a phone consultation about your options?

Yes a phone consultation will be good. Please give me a number to call.

Goal- I don’t know- Just want to know my options.

No other unpaid debts

The original owners was Chase Bank. I think the last payment was in 2010 not sure.

I am in Arizona.

Send an email reply to the comment notification you get. Those emails come to me. We can coordinate a time for the consultation. It will be me calling.

I was waiting for your call. Never receive one. Please either email or call. I want to write a letter to answer the summon. I just wanted someone look it over.

I did call back and leave a message with a gentleman that answered. You can reach me back after 11 am eastern.

You would be much better off talking with an attorney about your answer to the lawsuit. If you post the name of a nearby larger city I can email you contact information to attorneys in the area with debt collection defense experience.

We sold our house via short sale in Sept 2013. It had a 2nd lien on it and the lien holder told us the lien was released so the short sale could happen. We have been making monthly payments on it and just found out it wasn’t released – it was charged off. Its a 25,000 charge off so its killing our credit. We have every intent of continuing to make the payments until its paid off but would like to know if there’s any way to get the charge off removed?

Cindy – Who is it that charged off the debt? Who is it you are making payments to?

A lien release in order to pass title to the short sale purchaser is a completely different concern than a charged off loan on your credit report. How is the 1st showing on your credit? What are your credit goals for the next 2 to 3 years?

Michael –

The bank is Customers Bank – a small community bank in PA. We are still making payments to them as we always have. It shows as charged off on our credit reports in April but the house didn’t go to settlement until Sept . The first was CitiMortgage and one credit report its showing as Foreclosure in Process and the other 2 it shows as settled for a lesser amount. Because of my husband job, its highly doubtful that we will ever buy a house again but we still would like to get our credit repaired. Eventually we will need a new car and I’m concerned we wont qualify for a loan. Everything is current on our credit report -and has been for over a year – except for the 2 things that are related to the house.

Cindy

Thanks for the additional details Cindy. If these are tho only 2 negative/key derogatory on your credit reports, you are not in bad shape. If you do want to buy a home, and maintain positive credit activity from here, you are generally able to qualify for FHA type of loan underwriting 3 years after the foreclosure or short sale, sometimes sooner. You whould be in good shape to qualify for an auto loan within 12 to 24 months of those mortgage related credit dings.

24 months separation from a negative credit event is a general timeline to expect the most impact to your credit score and or ability to qualify for credit products. If you keep everything else current, have less than 30-ish percent credit utilization, and a debt to income ratio under 35/40 percent when calculating any new monthly payments into your budget, you are going to be fine.

It sounds like you just need some time at this point.

I had a line of credit with benefical for 9,500.00 that i had been paying faithfully for over 5 plus years up until 2 years ago i stopped paying on the loan due to financial hardship. It has been turned over to an attorney office for over 11,000.00. I then was contacted by an attorneys office saying i need to pay the amount owed in full. They continue to contact me on my job and cell phone harrasing me. My office manager at the time had to tell them i no longer work there to stop the calls. Ive recently started making payments to Benfical directly and they have been accepting the payments ive been making. But im still getting the attorneys letters and there calling my job again to speak to someone about wage garnesment. What are my options?

Shawn – Unfortunately, in situations like you have described, the attorney is who is in control of the collections while they have the file. Payments to Beneficial are likely being credited to pay down the overdue balance. If Beneficial no longer owned the account (debts are often sold off to debt buyers), but is accepting payments, that could be a problem.

Call Beneficial and ask if they still own the account. You can ask them to recall it, but I am skeptical that they will. If they do not own the account any longer, you are paying the wrong party.

All that said, even though payments are being sent in, you can actually still be sued. Are you in a position to be pull some money together to settle the debt and put this behind you? If all you can do is make payments, what amount can you afford each month?

So one of my credit card account is charged off. I had previously made payments but I recently become laid off and no longer can afford to make payments what are my options if any?

Jamel

Jamel – read through this article about the different debt solutions that may apply to your situation. Post any questions you may have in the comment section below that article and lets go from there.

I’d been worked aboard since 1/2008. I did not know there is judgment on the credit report/public record until now. The case filing NYC civil court, filing data: 5/2008, status: unknown, amount: 1675. When I searched the case index number at civil court website, it shows case status: disposed, so I called the court clerk? he said the judgment was satisfied on 9/2010. But the bank shows levy for 1959 back on 6/2008. Why they took 284 more then the judgment amount from my bank account? why the court take more then 2 years to update the case status? Will Civil court judge vacate SATISFIED JUDGMENT? Or I can only have the CRA update the judgment status to “satisfied” and wait for 2 years to get it of credit report/public record?

Thanks for your time..

Joe – With as long ago that this occurred, and given the legalities, you should connect with a consumer attorney familiar with defending against debt collectors to see about the possibilites of vacating the judgment. I can email you some contact info for some attorneys if you would like.

If the judgment is not showing as satisfied on your credit reports, but shows as satisfied in the court record, you can and should dispute this with the CRA’s to get it corrected.

Michael,

Thanks for the advise, please email me the contact info for attorneys. prefer the lower service charge attorney since I’m unemployed.

Thanks again for the quick respond.

Joe

We have a similar situation with HSBC. They have a lien on our home. The original law firm that put the lien on the home (as listed in the court order) back in 2010, is closed and we cannot contact them. When we try to call HSBC, we end up on hold for over 30 minutes without being able to talk to anyone at all. The only mailing addresses they give on line is for payments. We have no clue as to who to contact about reaching a settlement so we can remove our lien. We want to get a home equity and be able to resolve this but we need the lien removed first with a much lower amount.

Lisa – Is HSBC the named plaintiff in the lawsuit that was filed?

You do have some other options to consider for handling this debt, but it would be good to know if you were sued by your creditor, or a debt buyer, before I offer more feedback.

Beneficial Consumer Discount Company is listed as the plaintiff.

Thanks. You can contact BCDC in order to pursue the relief you need. If you want help, consider calling in to speak with a CRN specialist about your situation.

I have a client with a hsbc credit card jr lien on a property. We are short saling and need to pay off this lien. The original attorney who placed the lien says that it was sent back to HSBC, HSBC says its serviced by PRA. PRA can not take payment because it services not own the file that it just services it. Do you know who issues pay off lien demands for this type of situation?

Adrianna – Have your client call HSBC directly and ask if they still own the account, or if they sold it? If HSBC sold the debt, ask to whom? I expect the answer to be that HSBC sold it to PRA (portfolio recovery associates). If PRA owns the debt, or even if they are servicing the debt for HSBC, they would be able to respond to a title companies demand request. My suspicion is that the person contacted at PRA gave the wrong information.

There is one other possibility, but try the above first, starting with the call to HSBC. If this leads back to PRA, and it should, if you hear the same answers ask to speak with a supervisor or collections floor manager.